extended child tax credit 2022

The legislation made the existing 2000 credit per child more generous. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

That means eligible families will be able to claim the remaining 1800 in their tax returns.

. However there is high support for the direct payments to be extended into 2022. The maximum child tax credit amount will decrease in 2022. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. The future of the enhanced Child Tax Credit remains undecided. Distributing families eligible credit through monthly checks for.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Everyone in the Democratic party needs to vote for the bill. Ad Discover trends and view interactive analysis of child care and early education in the US.

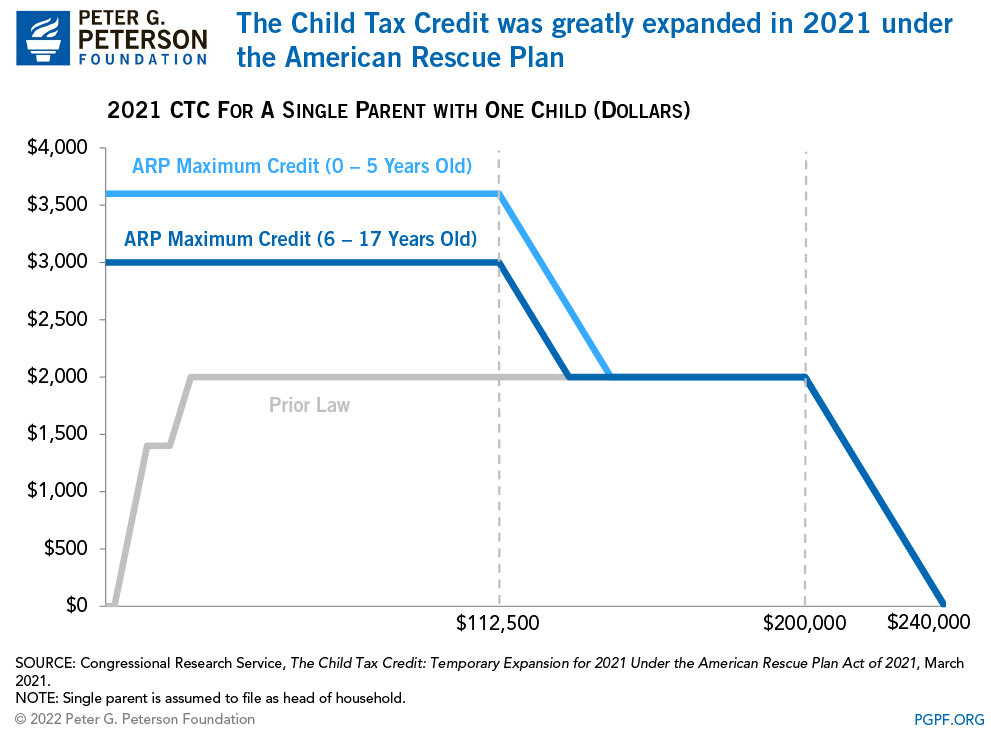

Gas Tax - For updated information on the. Under the one-time program couples filing joint taxes for 200000 or less in income last year can apply for direct payments at 250 for each child below age 18 and capped at 750 for three. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

For the second half of 2021 payments were sent monthly to most. Democrats Joe Manchin and Kyrsten. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more.

For children under 6 the amount jumped to 3600. The White House has also suggested that double-checks be sent out to make up for. While President Biden wants the child tax credit to be extended for 2022 the Build Back Better Actwhich contains this provision has not yet been passed.

In American plan of salvation was accepted into Congress in 2021 while increasing the amount eligible American families can receive from their Child tax credit payments. We will have Child Tax Credit in 2022 to help working families with income covered by the program. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000.

Check out The. The JCT has made estimates that the TCJA changes. In the meantime the expanded child tax credit and advance monthly payments system have expired.

There is the possibility that it is passed. The boosted Child Tax Credit pulled millions of children out of poverty in 2022. Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17.

The assessment was based on a survey wave right after the final payment was received. This credit does have a phase-out amount when you reach 400000 of adjusted gross income if you file married filing jointly or 200000. One senator said he could not vote for the bill and there needs to be a working requirement for those.

The American households should have gotten up to 1800 per child in Decembers payment. In 2017 this amount was increased to 2000 per child under 17. An earlier version of Democrats legislation originally pegged at 35 trillion would have extended the enhanced child tax credit value through 2025 instead of 2022.

Those who made slightly more than the. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. The latest research from Columbia shows.

As part of the American Rescue Plan Congress temporarily boosted the 2000 child tax credit to 3000 for income-eligible families for children ages 6 to 17 or 3600 for younger children. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Now parents are cashing in on the second part of the child tax credit with their 2022 tax refund.

When the child tax credit came to an end in December roughly 37 million more children suffered from poverty according to a study by Columbia University. Parents with one child can claim. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

As such there was. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

Whether Biden can extend the enhanced CTC for 2022 depends on the voting outcome of a. Get the up-to-date data and facts from USAFacts a nonpartisan source. Moreover in the second half of 2021 it became possible to.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Moreover in the second half of 2021 it became. While not everyone took advantage of the payments which started in July 2021 and ended in.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. So far the enhanced credit hasnt been back in play even though President Biden has pushed for it.

If thats the case the 3600 and 3000 credit will continue for 2022 with the advanced payments. Credits are extended throughout 2022. The thresholds for single-earner filers and heads of households are set at 100000 and 160000 respectively.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. Now parents are cashing in on the second part of the child tax credit with their 2022 tax refund. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100.

Eligible families are those who meet the requirements. The federal tax credit will revert back to 2000 per child maximum per year. You are single and your income is less than 75000.

The Department of Revenue Services will be closed on Monday July 4 2022 a state holiday. These payments were part of the American Rescue Plan a 19 trillion dollar. They can apply for extended credit and receive more money when they file their taxes.

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Tax Related Tips For Military Infographic Omni Military Loans Military Wife Life Financial Tips Military

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Solar Investment Tax Credit Itc Tax Credits Solar Investing

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Will The New Child Tax Credit Be Extended Forbes Advisor

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Reasons To Go Solar Energysage Solar Energy Panels Solar Energy Diy Solar Technology

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Parents Guide To The Child Tax Credit Nextadvisor With Time

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr